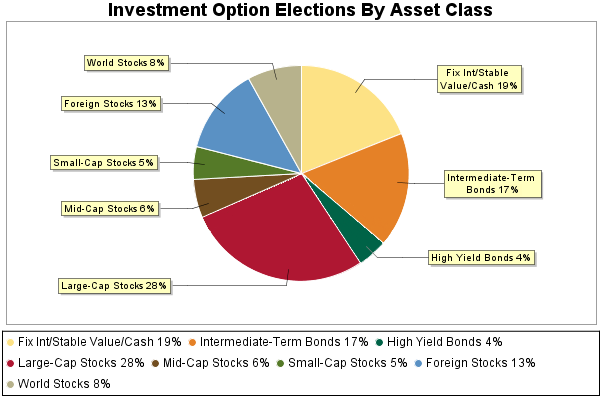

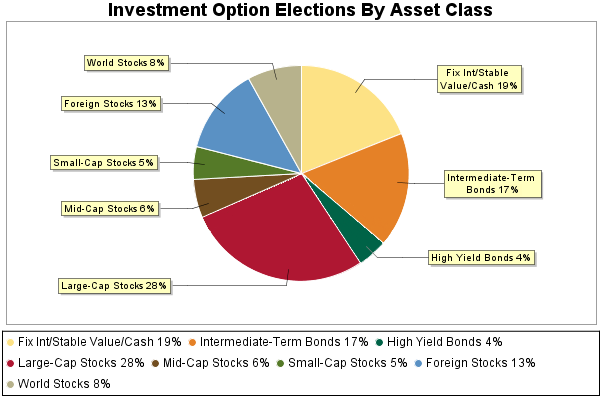

Fix Int/Stable Value/Cash |

|

|

AUL Fixed Account (FIXD) |

Fixed Int/Stable Val |

19.00% |

|

|

|

Fix Int/Stable Value/Cash |

|

|

OneAmerica Money Market (BMMK) |

Cash |

0.00% |

|

|

|

|

Total Fix Int/Stable Value/Cash |

|

|

|

19.00% |

|

|

|

Intermediate-Term Bonds |

|

|

PIMCO Total Return (PTRR) |

Int Term Bond |

17.00% |

|

|

|

|

Total Intermediate-Term Bonds |

|

|

|

17.00% |

|

|

|

High Yield Bonds |

|

|

Amer Fds Ameri High Inc Trst (AFHI) |

High Yield Bond |

4.00% |

|

|

|

|

Total High Yield Bonds |

|

|

|

4.00% |

|

|

|

Large-Cap Stocks |

|

|

AmCent Equity Income (AEIA) |

Large Cap Value |

0.00% |

|

|

|

Large-Cap Stocks |

|

|

OneAmerica Value (BVKK) |

Large Cap Value |

0.00% |

|

|

|

Large-Cap Stocks |

|

|

T Rowe Price Growth Stock (TLCG) |

Large Cap Growth |

28.00% |

|

|

|

|

Total Large-Cap Stocks |

|

|

|

28.00% |

|

|

|

Mid-Cap Stocks |

|

|

Goldman Sachs Mid Cap Value (GSML) |

Mid Cap Value |

0.00% |

|

|

|

Mid-Cap Stocks |

|

|

Fidelity Adv LevCo Stk (FALT) |

Mid Cap Blend |

0.00% |

|

|

|

Mid-Cap Stocks |

|

|

Thornburg Core Growth (TBCG) |

Mid Cap Growth |

6.00% |

|

|

|

|

Total Mid-Cap Stocks |

|

|

|

6.00% |

|

|

|

Small-Cap Stocks |

|

|

Fidelity Adv Small Cap (HASC) |

Small Cap Growth |

5.00% |

|

|

|

|

Total Small-Cap Stocks |

|

|

|

5.00% |

|

|

|

Foreign Stocks |

|

|

Thornburg International Value (TINV) |

Foreign Blend |

13.00% |

|

|

|

|

Total Foreign Stocks |

|

|

|

13.00% |

|

|

|

World Stocks |

|

|

Invesco Global Equity (AGTR) |

World Stock |

8.00% |

|

|

|

|

Total World Stocks |

|

|

|

8.00% |

|

|

|

Managed Asset Allocation |

|

|

Russell LifePoints® 2010 Strat (RS10) |

Mgd Asset Allocation |

0.00% |

|

|

|

Managed Asset Allocation |

|

|

Russell LifePoints® 2020 Strat (RS20) |

Mgd Asset Allocation |

0.00% |

|

|

|

Managed Asset Allocation |

|

|

Russell LifePoints® 2030 Strat (RS30) |

Mgd Asset Allocation |

0.00% |

|

|

|

Managed Asset Allocation |

|

|

Russell LifePoints® 2040 Strat (RS40) |

Mgd Asset Allocation |

0.00% |

|

|

|

|

Total Managed Asset Allocation |

|

|

|

0.00% |

|

|

|

Brokerage Window |

|

|

Ameritrade Account (XX) |

Broker Fund |

0.00% |

|

|

|

|

Total Brokerage Window |

|

|

|

0.00% |

|

|

|

Total Investment Allocation |

|

|

|

|

100.00% |

|

|

|

![]()

![]()